Receiving Payments

1) Custom Designed for Insurance Industry:

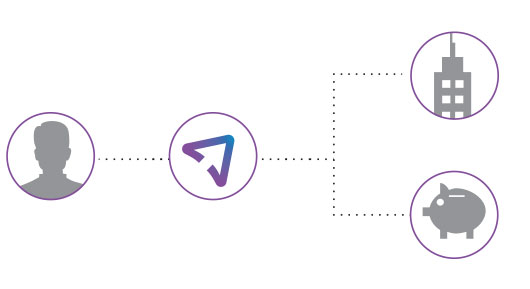

- Closed system that can only process payments from brokerages to carriers

- Works with multiple systems and accounts

- Carrier settled – funds are pulled by Carrier

2) Customize and Mange Users:

- Designate and manage users

- Customize user settings to determine access levels and notifications

3) Real Time Notifications:

- You receive full notice of pending payments upon brokerage authorizing payment

- Policy data is directly associated with payment

4) Access and Manage Payment Reports:

- View real time reports that identify payment stages as pending, authorized or deposited

- Access associated policy data needed for reconciliation

- View historical deposits by brokerage (filter search criteria)

5) Automated Reconciliation Report:

- Choose file format to receive data

- Direct web services feed available for straight through processing

- ClearPay utilizes a level of system protection on par with many international banking institutions, including 256 bit encryption and data exchanged with standard security protocols

- Funds are transferred based on established and safe banking procedures

- Read more about ClearPay security

Sending Payments

1) Seamless Integration to BMS:

- Ability to integrate to all major BMS’, allowing for brokers to start + finish within the BMS.

- ClearPay runs silently in the background.

2) Easy Installation:

- Easy automated wizard driven installation and set-up

- No upfront costs

- Local installation of connectivity tool to provide data to generate electronic payment and transmission of relevant policy data.

3) Pay Electronically:

- Funds are transferred using existing banking protocols.

- Broker authorized – payment amount and deposit date are controlled by broker

4) Multiple Users with Customized Authority Levels:

- Choose differing levels of authority in the brokerage – ability to view only, generate payments, or approve payments.

- Remote approval.

- Designated authorities in brokerage can approve payments wherever you have an internet connection – phone, tablet or computer.

5) Automated reconciliation report:

- Data and funds are transmitted based upon brokerages entries into BMS.

- Carriers receive real-time reconciliation reports in their preferred format.

- Funds are transferred based on established and safe banking procedures.

- ClearPay utilizes a level of system protection on par with many international banking institutions, including 256 bit encryption and data exchanged with standard security protocols… Read more.

ClearPay

ClearPay